ADGM: A Strategic Hub for Hedge Fund Investments in the UAE

Navigating through ADGM Fund licenses

The Abu Dhabi Global Market (ADGM) is a leading international financial centre in the UAE, strategically positioned to connect investors and businesses across the Middle East, Africa, and South Asia. Established in 2013, ADGM has quickly gained a reputation for its progressive regulatory framework, designed in alignment with international standards to provide a secure and transparent environment for financial activities.

What is Hedge fund?

Hedge funds are investment funds that use a variety of strategies to generate returns for their investors. Unlike traditional mutual funds, hedge funds have more flexibility in their investment approach, allowing them to profit from both rising and falling markets.

Hedge funds often involve complex financial instruments and risk management techniques. They typically target high-net-worth individuals, institutional investors, and other sophisticated investors who are willing to accept higher levels of risk in exchange for potentially higher returns.

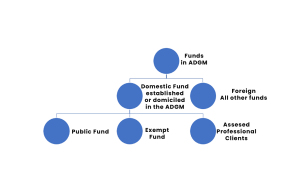

The ADGM permits both Domestic Fund Manager license and External Fund Manager license allowing for the management of Public, Exempt and Qualified investor funds.

Financial Services Regulatory Authority (FSRA)

The fund managers and the funds in ADGM are regulated by FSRA. It is the independent financial services regulator of ADGM. The FSRA is responsible for licensing and supervising financial intermediaries, including banks, insurance companies, exchanges and capital market intermediaries conducting financial activities in ADGM and within the financial free zone of Abu Dhabi.

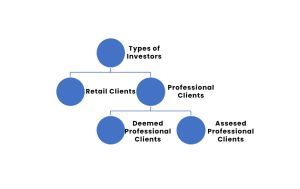

Types of investors in ADGM:

- Deemed Professional clients are usually Large Undertakings having balance sheet total of at least $20 million which includes large public institutions, financial institutions, global organisations etc.

- Assessed Professional Clients are usually clients having net asset of at least $1 million.

Dealing with retail clients is subject to meeting more regulatory requirements than dealing with professional clients

Types of funds in ADGM

ADGM supports three types of domestic funds, each tailored for different investor needs and access levels:

| Public Fund | Exempt Fund | Qualified Investor Fund | |

| Offer type | Public Offer | Private Placement | Private Placement |

| Client Type | All | Professional Clients | Professional Clients |

| Minimum Subscription | NA | $50000 | $500000 |

ADGM Asset Manager license

In order to conduct the activity of “Managing A Collective Investment Fund” in ADGM the firm must secure a Category 3C license. The license application is subject to approval of FSRA.

Capital Requirements for Fund Managers

The base capital requirement for managing Exempt Fund and Qualified Investor Fund in ADGM is $50000. However, the final capital requirement will be decided by ADGM after reviewing the size and scale of the operation proposed by the applicant.

Cost of setting up

The various costs involved in setting up a fund manager service in ADGM is below:

- License application fee of $10,000

- Annual supervision fee of $10,000

- Leasing cost $20000 (Average)

- Visa charges $3000 (Approx)

Why chose ADGM for hedge fund investments?

Setting up in ADGM your hedge Funds managing firm is one of the most lucrative investment options available in the UAE.ADGM’s regulatory framework, based on English Common Law and overseen by the Financial Services Regulatory Authority (FSRA), ensures transparency and strong governance. Also ADGM Fund managers can manage and promote non-ADGM funds as well as benefit from the funds passporting facility , making it an attractive location for hedge funds in the UAE.

Incorporating with ECAG Incorp.

When setting up in ADGM, partnering with ECAG Incorp. simplifies the incorporation process for entities. Our team provides essential support in navigating the regulatory landscape, ensuring that all compliance and operational requirements are met. With our expertise, you can focus on building your business expansion strategies while we handle the regulatory complexities, giving you a strong foundation for success in the ADGM.